are taxes cheaper in arizona than california

Arizona is basically quite cheaper than California. Arizona has four total income tax brackets with rates ranging from as low as 259 to as much as 450.

Pros And Cons Of Relocation To Oregon From California

Are apartments in Arizona cheaper than California.

. Arizona has lower taxes than California Arizona housing costs are less than much of California Much of Arizona is actually very nice and most residents love living there. This simply means that lower brackets pay lower rates and higher brackets pay higher rates. This is a one-time fee and there are separate additional fees based on the vehicles weight.

Looking into an overview of Property Taxes in Arizona vs California property taxes in Arizona are among the lowest in America with an average effective property tax rate of 062. This clearly implies that the state income tax of Arizona is lesser than that of California. Well be looking closely at this topic as new studies come to light.

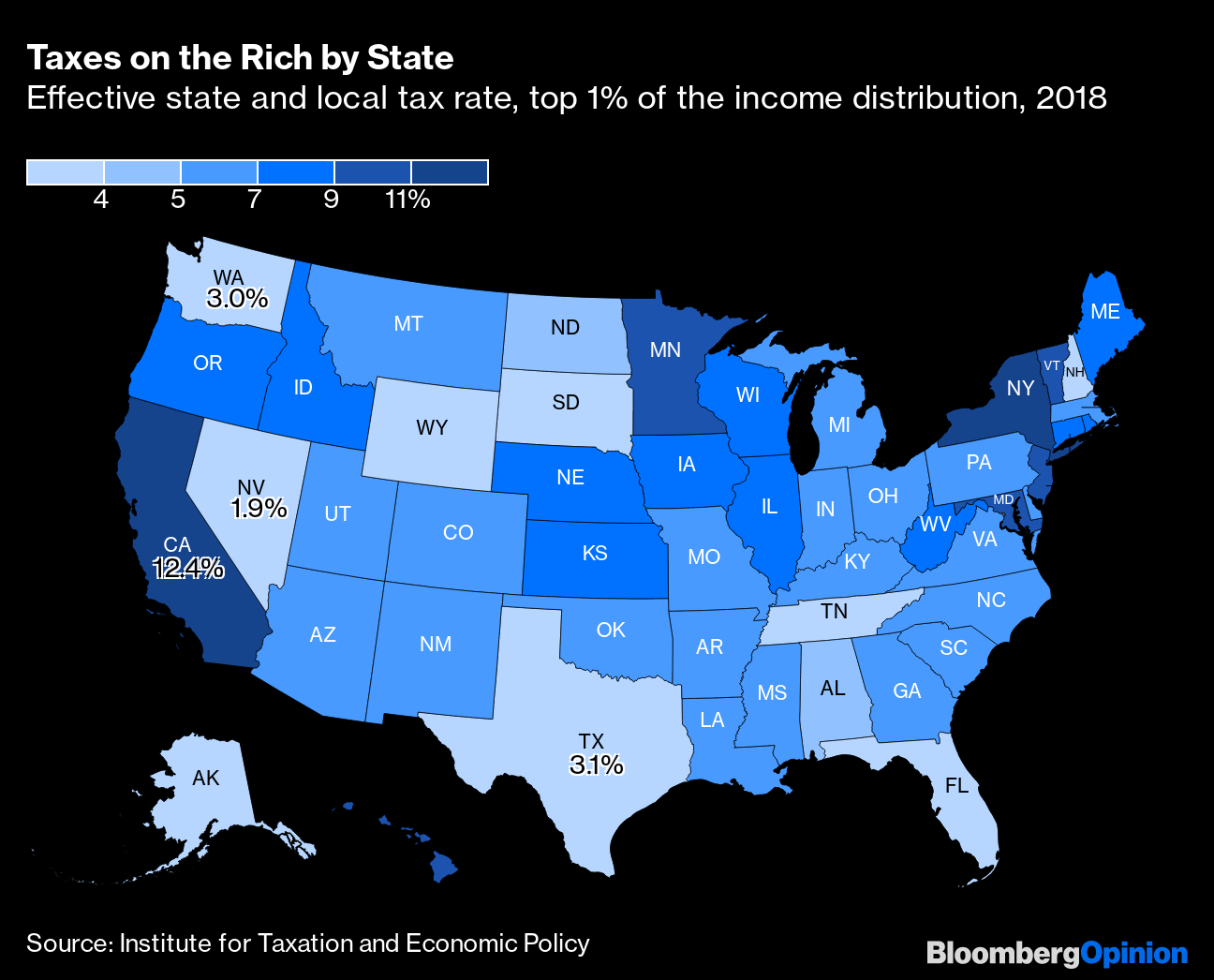

Cost of Living Indexes. Compare these to California where residents owe almost 5 of their income in sales and excise taxes and just 076 in real estate tax. This tool compares the tax brackets for single individuals in each state.

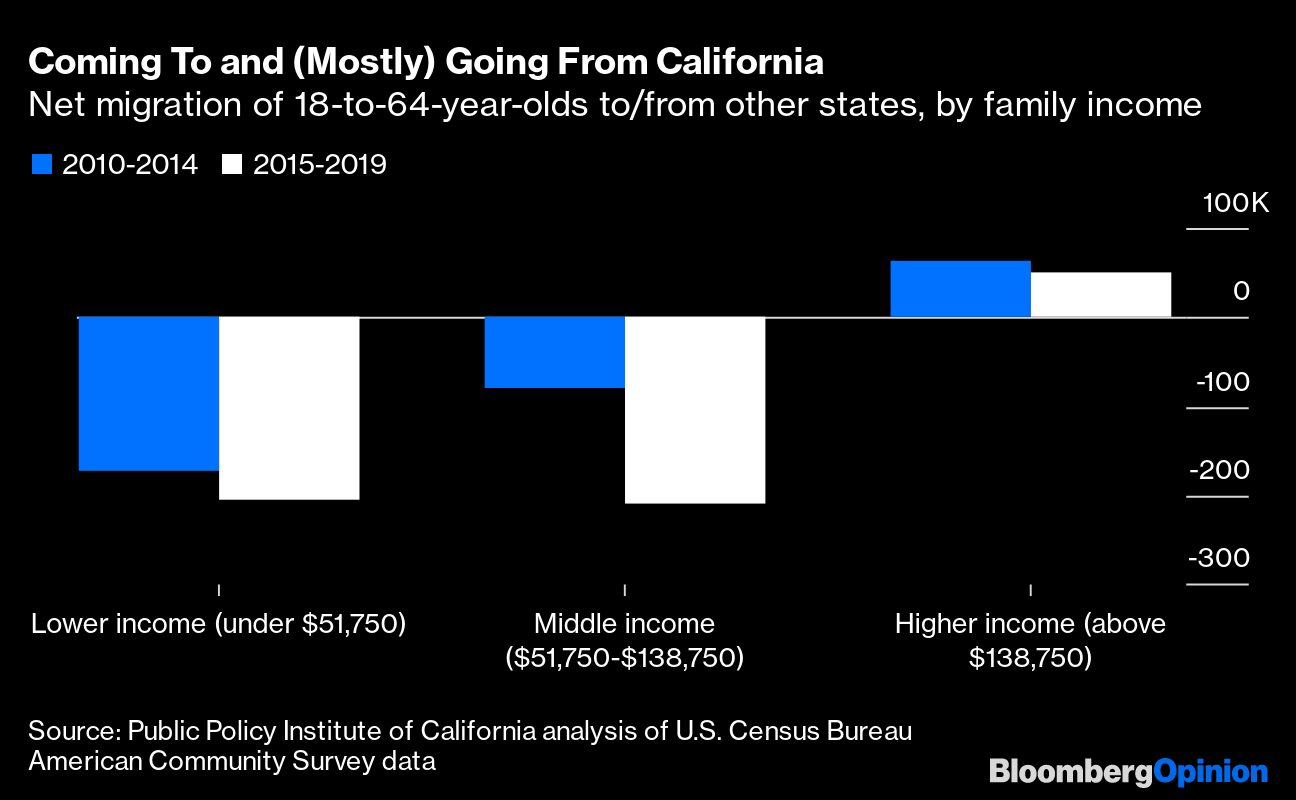

For more information about the income tax in these states visit the Oregon and California income tax pages. This is why there is such a large influx of California residents primarily moving to A. That puts the property tax rates in Arizona below the national average of 107.

While the range for the state income tax in California has 10 income brackets. It is not a secret that Californias real estate and cost of living is grossly inflated compared to Arizona. Massachusetts taxpayers pay 105.

California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those with income of 1 million or more which makes its highest actual tax rate 133. Like Arizona California also has a progressive income tax. Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country.

For income taxes in all fifty states see the income tax by. - Median Home Cost is the biggest factor in the cost of living difference. Why you need to go.

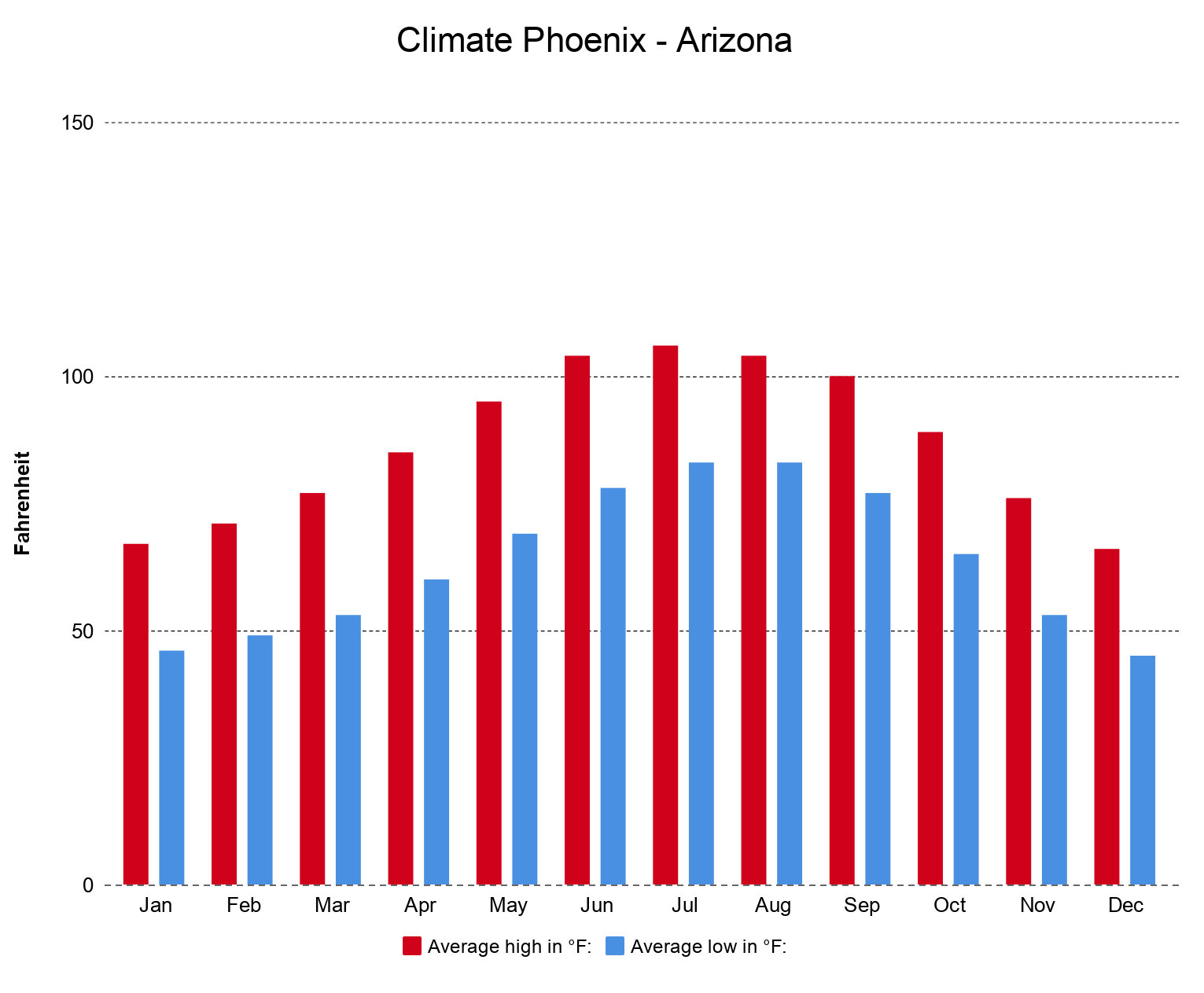

It is because it has a low tax rate has more facilities and has more benefits from the government. As this years tax-filing deadline April 18 comes closer its. - Overall Los Angeles California is 621 more expensive than Phoenix Arizona.

With the new tax reform bill in place its hard to know how federal income tax rates will change for Hawaii residents in the coming year. Florida follows with a new vehicle registration fee of 225. While the sales tax of California State is higher than that of Arizona State.

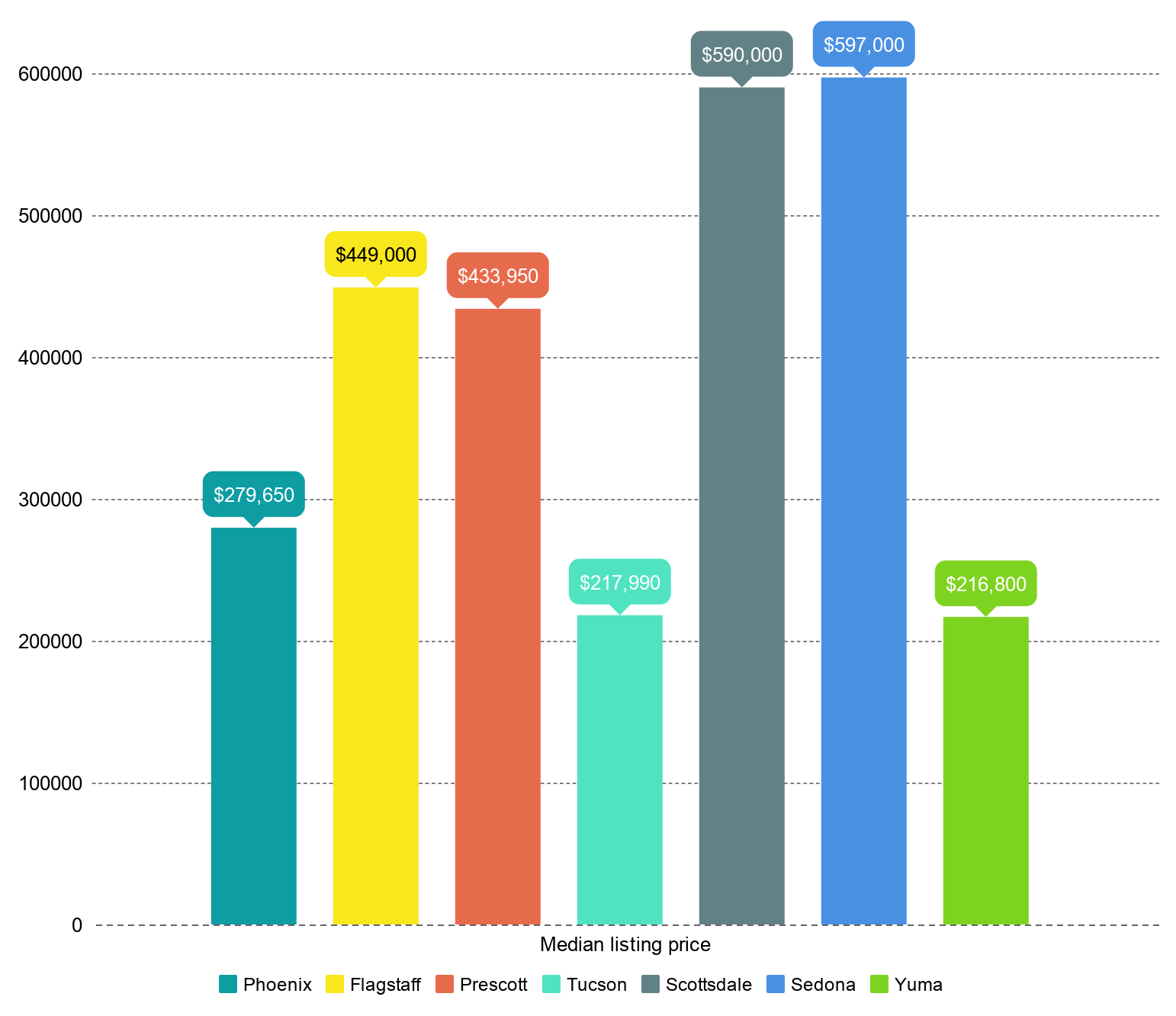

According to the Tax Foundation the five states with the highest top marginal individual income tax rates are. Arizona has the lowest registration fee. 906 for a 761 square-foot apartment.

The property taxes in California on aveage are also below the national average. The five states with the lowest top marginal individual income tax rates are. Up to 25 cash back 14.

2 New Jersey and New York also implement this type of millionaires tax. Use this tool to compare the state income taxes in Oregon and California or any other pair of states. If you compare the cost to apartments in Riverside CA averaging around 1594 for an 846 square-foot space.

In Arizona State the statewide sales tax is 56 and the local taxes have an average of about 84. But its still far lower than Californias rate of 133 which is the highest in the nation followed by Oregon at 99 and. The local taxes in different.

Registration fees following the first fee are 1450-3250. Based on this chart New Hampshire taxpayers pay 97 of their total income to state and local taxes. Im a little surprised with this A2A.

From food to housing everything is quite organized and calculated according to the budget. - Median Home Cost is 155 more expensive in Los Angeles. But the above chart provides a rather crude measurement of comparative state and local tax burdens because everybody is lumped together regardless of income.

See The View Of Landers Property In San Bernardino County Ca San Bernardino County Jefferson County Desert Hot Springs

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

Moving From California To Arizona Benefits Cost How To

Greetings From Southern California Vintage Travel Postcard Zazzle Com In 2022 Vintage Postcards Travel Travel Postcard California Beach

Moving Tips For Relocating To Another State Moving Tips States And Capitals United States Map

Where Does Arizona Rank In Cost Of Living Az Big Media

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Land For Sale In California Land For Sale Mohave County Rural Land

How To Move From California To Las Vegas Moving To Las Vegas Las Vegas Visit Las Vegas

Buy 11 77 Acres Land In Santa Margarita San Luis Obispo County Ca San Luis Obispo County San Luis Obispo Build Your Own House

How To Move From Arizona To Las Vegas In 2021 Moving To Las Vegas Las Vegas Las Vegas Nevada

Top Rated Arizona Pool Builder California Pools Landscapes Pools For Small Yards Small Pool Design California Pools

How To Move From California To Las Vegas In 2021 Moving To Las Vegas Las Vegas Visit Las Vegas

Pros And Cons Of Moving From California To Arizona Californiamoversusa

/US_states_by_GDP_per_capita_nominal-f89d1ca278a649a9b47e858ee41e7f09.png)

Cost Of Living In Texas Vs California What S The Difference

Pros And Cons Of Moving From California To Arizona Californiamoversusa